LG U+ builds happiness for shareholders, customers and staff

LG U+ offers various convenient services aimed at maximizing corporate values and considering both shareholders and customers.

Dividend Policy

LG U+ seeks to increase dividend payout ratio from a long-term perspective to enhance shareholder value and expand shareholder return.

Dividends are determined based on a balance between securing financial resources for long-term growth and returning to shareholders by comprehensively considering the business environment such as financial performance, cash flow etc.

In this respect, LG U+ announced its shareholder return policy for FY2024~FY2026 in 2024, as below.

[FY2024~FY2026 Shareholder Return Policy]

Total dividend payout will be determined by allocating at least 40% of the net income according to the

separate financial statements, excluding any one-time non-recurring profits. Furthermore, the company

commits to maintaining the annual cash dividends at a minimum level equal to the dividend per share paid

in fiscal year 2023.

By communicating with the market through this long-term dividend policy, LG U+ will strengthen sustainable management and improve the predictability of shareholder return.

Dividends are discussed in-depth at the board of directors, and the results are immediately communicated through a ‘Decision on Cash Dividend and Dividend in Kind.’ We are actively communicating with the market about the expected dividend outlook through the quarterly earnings results.

Dividend Status

| 구분 | 2023 |

|---|---|

| Par Value Per Share(KRW) | 5,000 |

| Net Income | 646,301 |

| Total Dividend | 279,388 |

| Payout Ratio(%) | 43% |

| Dividend Per Share(KRW) - Interim | 250 |

| Dividend Per Share(KRW) - Year-end | 400 |

| Market Price Dividend Ratio(%) | 6.2% |

| 구분 | 2022 |

|---|---|

| Par Value Per Share(KRW) | 5,000 |

| Net Income | 661,692 |

| Total Dividend | 279,388 |

| Payout Ratio(%) | 42% |

| Dividend Per Share(KRW) - Interim | 250 |

| Dividend Per Share(KRW) - Year-end | 400 |

| Market Price Dividend Ratio(%) | 5.5% |

| 구분 | 2021 |

|---|---|

| Par Value Per Share(KRW) | 5,000 |

| Net Income | 679,147 |

| Total Dividend | 237,566 |

| Payout Ratio(%) | 35% |

| Dividend Per Share(KRW) - Interim | 200 |

| Dividend Per Share(KRW) - Year-end | 350 |

| Market Price Dividend Ratio(%) | 3.7% |

| 구분 | 2020 |

|---|---|

| Par Value Per Share(KRW) | 5,000 |

| Net Income | 452,541 |

| Total Dividend | 196,475 |

| Payout Ratio(%) | 43% |

| Dividend Per Share(KRW) - Interim | - |

| Dividend Per Share(KRW) - Year-end | 450 |

| Market Price Dividend Ratio(%) | 3.7% |

| 구분 | 2019 |

|---|---|

| Par Value Per Share(KRW) | 5,000 |

| Net Income | 445,644 |

| Total Dividend | 174,645 |

| Payout Ratio(%) | 39% |

| Dividend Per Share(KRW) - Interim | - |

| Dividend Per Share(KRW) - Year-end | 400 |

| Market Price Dividend Ratio(%) | 2.8% |

Unit : KRW in millions

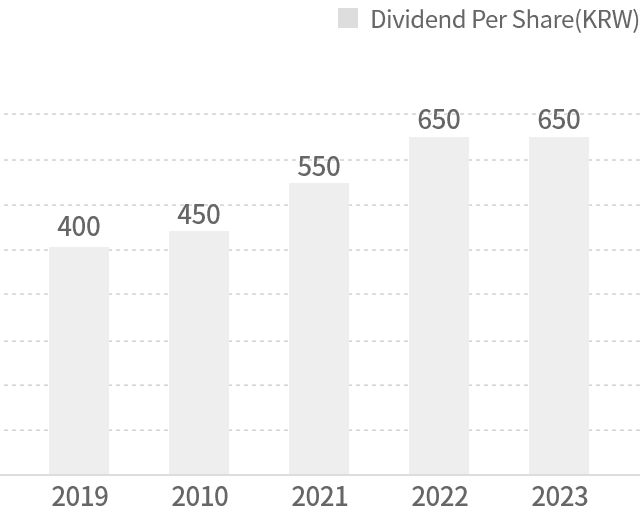

Dividend Per Share(KRW)

-

2019

- Dividend Per Share : 400

-

2020

- Dividend Per Share : 450

-

2021

- Dividend Per Share : 550

-

2022

- Dividend Per Share : 650

-

2023

- Dividend Per Share : 650